Encumbrance vs Non-Encumbrance-Key Differences Explained

Encumbrance vs. Non-Encumbrance certificate Guide

Encumbrance vs. Non-Encumbrance certificate Guide

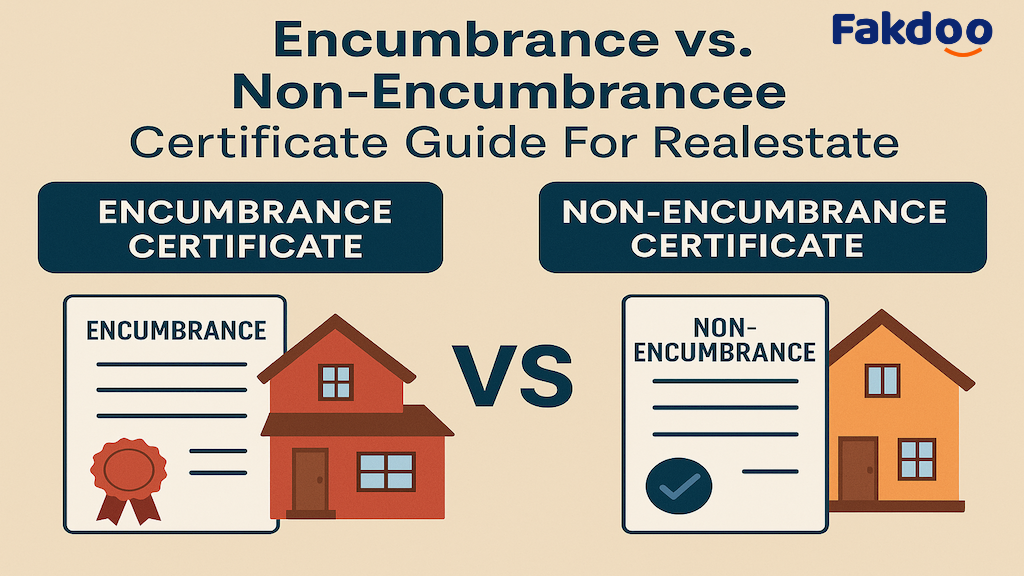

When it comes to ownership of property, particularly that of real estate and legal papers, two terms tend to come up: Encumbrance and Non-Encumbrance. As a buyer, seller, or investor, knowing these terms is important in order to prevent legal issues and have a smooth transaction.

In this blog, let us discuss what encumbrance and non-encumbrance are, how important they are, and the most significant differences between the two.

What is an Encumbrance?

An encumbrance is a legal claim, responsibility, or limitation on a property that can be restrictive to its usage or transfer. It implies that the property is not completely free of legal or financial burdens.

Typical Forms of Encumbrances:

Bank or financial institution liens or charges:

Encumbrance Certificate (EC)

- An Encumbrance Certificate is a formal document that the Sub-Registrar's office issues showing all registered financial or legal dealings (sale, mortgage, lease) involving a property within a specified time range.

What is a Non-Encumbrance?

- A non-encumbrance indicates that the property does not have any legal encumbrances, loans, disputes, or restrictions upon it is absolutely free and clear. In other words, it is a "clean title."

- Non-Encumbrance Certificate is not a standalone document but usually a reference to an Encumbrance Certificate indicating "No Encumbrance" for a specific time period. It means the property has not been engaged in any transaction such as a mortgage or lawsuit during that time period.

Why is it Important to Check for Encumbrances?

How to Get an Encumbrance Certificate?

Conclusion:

Whether you are purchasing a house or investing in property, knowing the encumbrance status of a property is imperative. An encumbered property may carry legal baggage, but a non-encumbered property makes you tension-free and ensures hassle-free transfer of ownership.

Always get a recent Encumbrance Certificate prior to any agreement it's a small step that can help avoid big risks in the future.

Pro Tip:

If you find a "Nil Encumbrance" noted in the certificate, it does not necessarily indicate that all is well. Always check with a lawyer or property expert, particularly for big investments.

Gujarat, known for its industrial strength and forward-thinking infrastructure, is experiencing a real estate renaissance — largely fueled by the expansion of GIFT City (Gujarat International Finance Tec-City). As India’s first operational smart city and international financial services centre (IFSC), GIFT City is not just transforming Gandhinagar’s skyline but also reshaping the future of Gujarat’s real estate landscape.

In this blog, we’ll explore how GIFT City’s expansion is impacting real estate in Gujarat — from housing and commercial investments to infrastructural development and employment growth.

What is GIFT City?

GIFT City is a visionary project by the Government of Gujarat, aimed at creating a global financial and technology hub. With state-of-the-art infrastructure, tax incentives, world-class amenities, and a robust regulatory framework, it competes with major financial centres like Dubai, Singapore, and London.

Key features include:

Real Estate Boom Around GIFT City

1. Surge in Residential Demand

With thousands of professionals expected to work in GIFT City, the demand for quality housing nearby has skyrocketed. Areas like Gandhinagar, Raysan, Randesan, and parts of North Ahmedabad are seeing:

2. Commercial and Office Space Growth

Many MNCs and financial institutions are setting up offices in GIFT City. This is driving the demand for:

3. Retail and Hospitality Expansion

To support the growing population and workforce:

Itment Opportunities

The GIFT City expansion presents lucrative investment opportunities across all real estate sectors:

Infrastructure Development as a Catalyst

The Gujarat government is actively investing in infrastructure to complement GIFT City:

These improvements are pushing real estate growth further, particularly in the Ahmedabad-Gandhinagar corridor.

GIFT City’s Global Appeal and Policy Push

Government policies such as:

are attracting global investors and developers, making Gujarat a hotspot for international real estate investment.

Final Thoughts

The expansion of GIFT City has turned Gujarat into one of India’s most promising real estate destinations. From being an industrial state to now a global financial hub, Gujarat is offering sustainable, futuristic, and high-return real estate opportunities.

Whether you're a first-time homebuyer, a seasoned investor, or a real estate developer, now is the time to explore Gujarat — not just for what it is, but for what it is rapidly becoming.

Tip for Investors:

Focus on areas within 10-15 km radius of GIFT City for optimal growth in the next 5-10 years. Residential plots, commercial spaces, and rental-focused flats are in high demand and can yield excellent returns.

Dholera is more than just a name weit’s India’s vision of a technologically advanced, sustainable, and future-ready urban space. As the first planned smart city of India, Dholera is leading the country toward a new era of infrastructure development and economic growth. Located in Gujarat, this ambitious project under the Delhi-Mumbai Industrial Corridor (DMIC) is gaining significant attention from investors, industries, and real estate developers.

Where is Dholera Located?

Dholera is strategically located about 100 km southwest of Ahmedabad in Gujarat. It lies within the Dholera Special Investment Region (SIR), covering over 920 sq. km—making it one of the largest greenfield smart city projects in India.

What Makes Dholera India’s First Planned Smart City?

Dholera was not an upgrade of an existing city but a city designed and developed from scratch, integrating smart technologies and sustainable planning from the ground up. Here's what makes it stand out:

1. Integrated Infrastructure

2. World-Class Transport Connectivity

3. Environment-Friendly Urban Planning

4. Smart Governance

Investment Opportunities in Dholera

Dholera offers vast potential for investors and businesses. Key sectors include:

With 100% FDI approval, single-window clearance, and proactive state policies, Dholera is a hotbed for domestic and global investors.

Residential and Commercial Projects

Leading developers are already launching plots, villas, apartments, and commercial spaces in Dholera. Property prices are still affordable compared to metro cities, making this the right time to invest.

Current Development Status (2025 Update)

Dholera’s Future Vision

By 2040, Dholera is expected to host:

Over 2 million residents

Over 800,000 jobs

Smart mobility (EVs, autonomous transport)

Global-standard urban services

Why You Should Keep an Eye on Dholera

Long-term capital appreciation

Smart living and work environment

Sustainable and tech-driven infrastructure

First-mover advantage for early investors

Conclusion:

Dholera isn’t just a smart city—it’s a symbol of India’s urban transformation. Whether you're a homebuyer, investor, entrepreneur, or policymaker, Dholera offers limitless potential for the future. Don’t miss your chance to be a part of India’s most ambitious city project.

India's rapid infrastructure development is not only enhancing connectivity but also reshaping the real estate landscape. With a series of high-speed expressways connecting major cities and industrial corridors, property values are witnessing unprecedented growth along these routes. This blog explores the top 10 expressways in India that are revolutionizing real estate growth and driving investor interest across the nation.

Why Expressways Matter in Real Estate Development?

The connection between expressways and real estate is stronger than ever. Improved road networks reduce travel time, encourage urban expansion, and unlock new areas for residential, commercial, and industrial development. These expressways act as economic lifelines, making real estate investment along their corridors a lucrative opportunity.

Top 10 Expressways in India Boosting Real Estate Growth

1. Delhi–Mumbai Expressway

2. Yamuna Expressway (Noida to Agra)

3. Mumbai–Pune Expressway

4. Eastern Peripheral Expressway (EPE)

5. Western Peripheral Expressway (KMP Expressway)

6. Agra–Lucknow Expressway

7. Purvanchal Expressway

8. Ahmedabad–Vadodara Expressway

9.Bangalore–Mysore Expressway (NH-275):

10.Hyderabad Outer Ring Road (ORR):

How Expressways Influence Property Values:

1. Reduced Travel Time = Higher Demand

2.Boost to Commercial & Industrial Projects

3.Affordable Options on the Outskirts

Real Estate Investment Tips Along Expressways:

Conclusion:

India’s top expressways are doing more than just connecting cities they’re redefining real estate dynamics As infrastructure continues to expand, the real estate sector stands to benefit from increased accessibility, affordability, and economic activity.

If you're a real estate investor developer, or homebuyer, keep a close watch on these expressway corridors. The road to your next great investment might just be paved with expressway lanes.

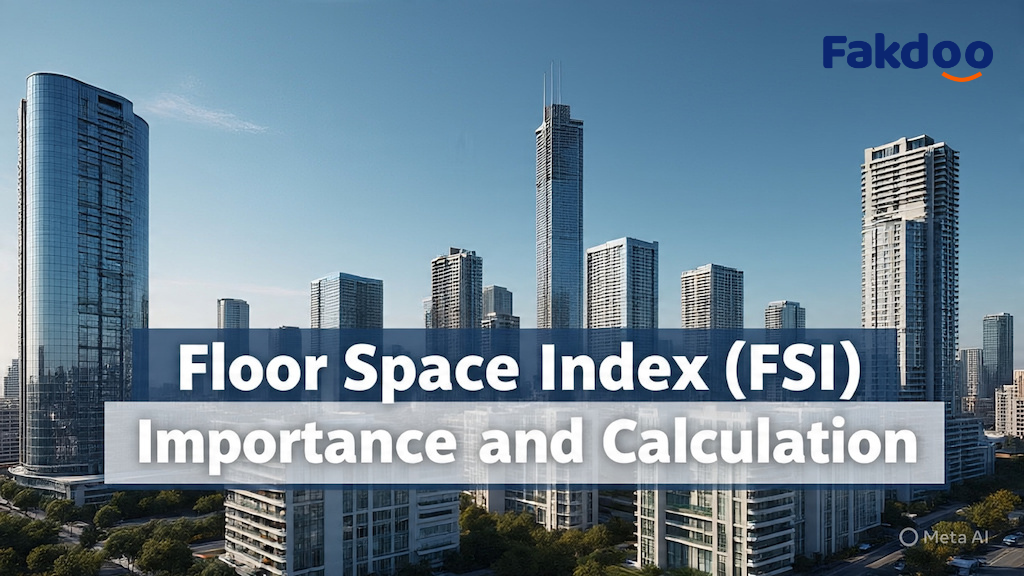

One of the most significant factors in real property is Floor Space Index (FSI), also referred to as Floor Area Ratio (FAR). FSI is defined as the total area of land that will be utilized during development. FSI is a ratio of floor area covered out of available land.

The FSI is determined by the local regulatory authorities or bodies, and it is generally determined by the Code of Building. The National Building Code of India generally provides guidelines for building construction.

FSI may be utilized to understand the desirability of the location and the population density.

In addition, comprehending the FSI is crucial, even from an ecological point of view. Since usually there are fewer spaces open if the FSI is high, the homebuyers need to consider this.

Understanding FSI and FAR:

FAR and FSI are the same but stated differently. A FAR is a decimal, while an FSI is a percentage. The FSI may vary from city to city and even within one city from one area to another. Based on the number of stories in the building, FSI may vary even in one location. FSI is regulated by city zone, building type, and other characteristics.

Prior to starting any project, contractors are required to send plans for the proposed building for approval to the respective zone. Such details involve whether the construction will be residential or commercial, how tall and what structure it would be, how big the plot of land on which it would be constructed, etc.

The place is the foremost feature that impacts the FSI directly. The FSI is usually higher in places with metros due to the limited space. But with the vast tract of land available for construction, FSI can be low in rural areas.

Some local government authorities compute higher FSIs based on area of land. Because the road is wide, any plot near one will have an increased FSI. The FSI can be computed through a simple formula using the built-up area and the area of the plot.

Floor Space Index (FSI) Formula

Floor area of all the floors and land plot area are needed to calculate the Floor Area Ratio (FAR) or Floor Space Index (FSI). It can then be estimated by the following:

FAR = Total Floor Area of All Floors of the Building/Plot Area

FSI = Total Floor Area of All Floors of the Building/Plot Area × 100

If FAR is 1, the entire plot area can be utilized as per this parameter. If FAR is less than 1, the land is underdeveloped at several places. Once again, the build-up has more than one story if FAR is more than 1.

Floor Space Index (FSI) Calculation:

Suppose you want to build a 2000-square-foot building on a piece of property which is 1000 square feet. Applying the above formula, then:

=> FAR = 2000 / 1000

=> FAR = 2

In FSI, the value is 200% if the FAR value is 2. This means that they can construct 2000 square feet on a land of 1000 square feet.

In addition, the municipal council considers the road width and other factors when determining the Floor Space Index (FSI) of a certain locality.

Importance of Floor Space Index (FSI)

FSI value determines the value of land in a particular region. Thus, this value determines whether and how much land can be utilized for a building. The FSI value differs from one location to another and is based on the number of stories each building has. Thus it is only fixed over some locations.

he FSI ensures disciplined development in every sector, such as railroad stations, commercial and residential buildings, etc., to meet the schedules, thus rendering city development and planning more standardized. This may assist in marking open areas clearly from construction areas.

No unauthorized development is allowed either.

Affordability also comes into the picture due to the fact that more FSI enables builders to construct more and sell more. This will prove handy in places where houses for all are in dire need. Less FSI implies lesser use of that piece of land for development. If the FSI builds the building, then the builder is not exposed to questions about NOCs.

Pros of Having FSI in Cities:

F.S.I. can be taken as a constraint, though it has benefits in urban areas or some areas where development is progressing very rapidly.

It maintains the ratio of developed to free space constant.

Consequently, it maintains the skyline of the city intact.

A mean value of F.S.I ensures successful development of the project.

Hence, it is important to have balance between development and planned, consistent growth.

Disadvantages of FSI:

F.S.I is considered to be a poor indicator of physical fitness there. This means that the employment of and the concept of housing the ever-growing population face lower values of F.S.I.

Therefore, one has to make an average F.S.I work as a strength and produce a 'product' that deals with all the problems at hand.

ConclusionL:

The highest floor area that can be constructed over a certain plot is calculated using the floor space index, commonly referred to as the floor area ratio. It's calculated from several variables, such as amenities, building type, and city zone classification.

The builder needs to stay within the previously determined government-approved floor space index during construction. The floor space index/area ratio greatly influences the total cost of the building. FSI is impacted by many variables, such as style of the building, size of the lot, place or location, and so on.

When it comes to ownership of property, particularly that of real estate and legal papers, two terms tend to come up: Encumbrance and Non-Encumbrance. As a buyer, seller, or investor, knowing these terms is important in order to prevent legal issues and have a smooth transaction.

In this blog, let us discuss what encumbrance and non-encumbrance are, how important they are, and the most significant differences between the two.

What is an Encumbrance?

An encumbrance is a legal claim, responsibility, or limitation on a property that can be restrictive to its usage or transfer. It implies that the property is not completely free of legal or financial burdens.

Typical Forms of Encumbrances:

Bank or financial institution liens or charges:

Encumbrance Certificate (EC)

- An Encumbrance Certificate is a formal document that the Sub-Registrar's office issues showing all registered financial or legal dealings (sale, mortgage, lease) involving a property within a specified time range.

What is a Non-Encumbrance?

- A non-encumbrance indicates that the property does not have any legal encumbrances, loans, disputes, or restrictions upon it is absolutely free and clear. In other words, it is a "clean title."

- Non-Encumbrance Certificate is not a standalone document but usually a reference to an Encumbrance Certificate indicating "No Encumbrance" for a specific time period. It means the property has not been engaged in any transaction such as a mortgage or lawsuit during that time period.

Why is it Important to Check for Encumbrances?

How to Get an Encumbrance Certificate?

Conclusion:

Whether you are purchasing a house or investing in property, knowing the encumbrance status of a property is imperative. An encumbered property may carry legal baggage, but a non-encumbered property makes you tension-free and ensures hassle-free transfer of ownership.

Always get a recent Encumbrance Certificate prior to any agreement it's a small step that can help avoid big risks in the future.

Pro Tip:

If you find a "Nil Encumbrance" noted in the certificate, it does not necessarily indicate that all is well. Always check with a lawyer or property expert, particularly for big investments.

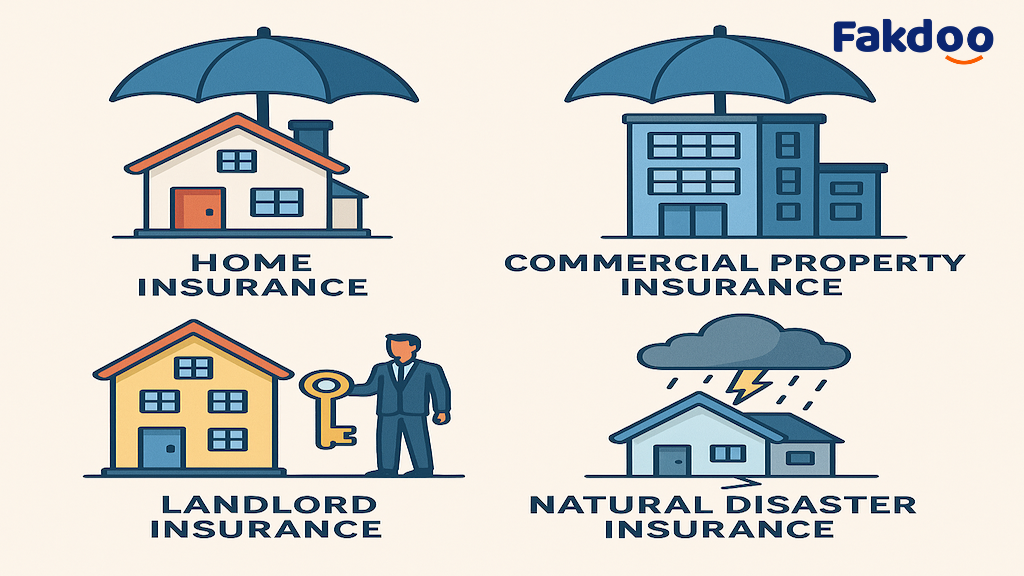

Whether you're a homeowner, landlord, or business, your property is one of your greatest assets. What if something happens to it, though, and it gets damaged by fire, floods, theft, or acts of nature? That's where property insurance steps in.

Throughout this blog, we'll guide you through what property insurance is, why it's important, the various types out there, and how to select the most appropriate coverage for your needs.

What is Property Insurance?

Property insurance** is a form of insurance that covers your physical property such as your home, office, or rented building against loss or damage due to factors like fire, theft, vandalism, and natural disasters. It helps ensure you don't incur massive financial losses in case your property is destroyed or damaged.

This type of insurance usually protects:

Why is Property Insurance Important?

1. Financial Protection: It covers losses arising from unforeseen damage or theft.

2. Loan Requirement: Insurance is usually required by most banks to grant a home loan.

3. Peace of Mind: Having the knowledge your investment is insured provides emotional security.

4. Disaster Preparedness: Enables quick recovery from floods, earthquakes, or fires.

5. Legal Liability: Pays for legal fees if a person gets harmed on your property.

Types of Property Insurance in India:

1. Home Insurance

2. Commercial Property Insurance

3. Landlord Insurance

- Insures rental properties and covers the structure of the building, possible legal damages, and loss of rent.

4. Renter's/Tenant's Insurance

- Insures personal items in a rented home but not the building itself.

5. Natural Disaster Insurance

What Does Property Insurance Usually Cover?

NOTE: Coverage may differ based on the insurer and policy type. Always check the fine print.

What's Not Covered? (Common Exclusions)

* Intentional damage

* Wear and tear

* War or nuclear risks

* Poor maintenance

* Damage caused by pests (e.g., termites, rodents)

* Undeclared or underinsured assets

How to Choose the Right Property Insurance Policy:

1. Determine the Value of Your Property & Contents

Don't under-insure cover cost of rebuilding and replacing valuable property.

2. Compare Policies Online

Compare insurance policies using comparison websites to get the best combination of coverage and premium.

3. Check Add-ons & Riders

Personalize your policy with add-ons such as earthquake or flood cover.

4. Read the Terms & Conditions

Know what's included, what's excluded, and what documents you'll need if there's a claim.

5. Select a Reliable Insurer

Opt for those companies that have a reputation for settling claims fast and have high customer service.

How to Make a Property Insurance Claim

1.Report the insurer at once after the damage or loss.

2.Get images of the damage with photos and video.

3. Make a police report (where there has been theft or vandalism).

4. Send all the documents such as proof of ownership, FIR, estimate of repairs, etc.

5. Follow up periodically until the claim settles.

How Much Does Property Insurance Cost?

The premium varies based on:

* Location and size of property

* Sum insured (property and content value)

* Type of coverage chosen

* Risk profile (high-risk flood area, crime rate, etc.)

In general, home insurance premiums are relatively low usually ranging from as low as ₹500–₹2,000 a year for minimum coverage.

Conclusion

Property insurance is not just a safety net—it’s a smart investment in your future. Whether you’re protecting your family home or your business premises, having the right policy in place ensures that one accident or disaster doesn’t wipe out years of hard-earned savings.

Gujarat has traditionally been India's industrial heartland. With its location at the center of India, investor-friendly policies, and superior infrastructure, the state remains a magnet for large-scale investments in industry and infrastructure. Among the most exciting initiatives in this context is the Becharaji Industrial Park, which lies within the Mandal Becharaji Special Investment Region (MBSIR). This is increasingly becoming a center for smart, sustainable industrialization in Gujarat.

What is Becharaji Industrial Park?

Becharaji Industrial Park is one of the ambitious MBSIR, a Special Investment Region spanning almost 102 square kilometers. It lies in North Gujarat close to Mehsana and is strategically located to cater to strategic industrial corridors, particularly the Delhi-Mumbai Industrial Corridor (DMIC).

The park aims to facilitate intelligent industrial growth by emphasizing the manufacture of automobiles, engineering, electronics, and logistics. The park has some of the big automobile players, including Suzuki Motor Gujarat, which has set up one of its largest production units here.

Major Features of Becharaji Industrial Park

Becharaji is most famous for its automobile cluster, with Suzuki and its Tier-1 and Tier-2 vendors having operations spread across the area. Other industries too, however, are finding a niche space here:

Gujarat provides a strong policy framework with the Gujarat Industrial Policy 2020, offering:

Employment & Economic Impact:

Becharaji Industrial Park is likely to create more than 2 lakh direct and indirect employment opportunities in the coming decade. It is not only an industrial hub but also a catalyst of regional development, elevating neighboring towns and villages with improved infrastructure, education, and employment prospects.

Future Outlook

With continued growth of exclusive freight corridors, intelligent utilities, and public-private partnership models, Becharaji Industrial Park is ready to emerge as a manufacturing hub in the world. Investors who would like to benefit from India's industrial upsurge should find MBSIR a desirable location.

Conclusion:

Becharaji Industrial Park is an example of Gujarat's dedication to smart, inclusive, and sustainable industrialization. You are either an investor, entrepreneur, or policymaker, this park is the future of industrial excellence in India.

The commercial real estate sector is experiencing a strong revival, and 2025 is shaping up to be a landmark year. With shifting business landscapes, expanding industries, and increased investor confidence, the demand for commercial property leases is witnessing a noticeable rise across major cities in India and globally.

Whether you're a business owner, investor, or real estate developer, understanding this surge is crucial to making informed decisions.

Why Is Commercial Leasing on the Rise in 2025?

1. Post-Pandemic Business Expansion

Companies that paused growth plans during the pandemic are now aggressively expanding. From tech startups to logistics giants, businesses are leasing office spaces, warehouses, and retail outlets to meet growing operational needs.

2. Boom in E-commerce and Warehousing

The rapid growth of online shopping has led to higher demand for logistics hubs, warehouses, and distribution centers. Leasing large industrial spaces has become essential for businesses aiming to scale efficiently.

3. Hybrid Work Culture Stabilizing Office Demand

While remote work persists, many organizations are adopting hybrid models. This has fueled demand for flexible office spaces in business districts and co-working hubs in tier-1 and tier-2 cities.

4. Favorable Government Policies

Initiatives like Make in India, Smart Cities Mission, and ease of doing business reforms have encouraged domestic and foreign businesses to set up operations, increasing the leasing activity in commercial zones.

5. Rising Investor Confidence

Real estate investors are seeing commercial property as a stable and high-yield asset. Leasing demand ensures consistent rental income and long-term value appreciation, making it a popular choice in 2025 portfolios.

Key Commercial Segments Driving the Demand

Locations in India Witnessing High Leasing Demand in 2025

Tips for Investors & Businesses

Conclusion:

The commercial leasing market in 2025 is on a steady upward trajectory, driven by economic recovery, evolving work models, and increased investor interest. For anyone looking to lease, invest, or develop commercial property, now is the time to act.

Buying your dream home in Gujarat just got easier with the Pradhan Mantri Awas Yojana (PMAY) — a government scheme offering home loan subsidies for eligible applicants. Whether you're a first-time homebuyer or looking to make housing more affordable, this blog will guide you step-by-step on how to apply for a home loan subsidy in Gujarat.

What is a Home Loan Subsidy?

A home loan subsidy is a financial assistance provided by the government under schemes like PMAY. Through this, eligible individuals get interest rate reductions on home loans making monthly EMIs much more affordable.

The Credit Linked Subsidy Scheme (CLSS) under PMAY is specifically designed for this purpose.

Who is Eligible for Home Loan Subsidy in Gujarat?

You can apply for the PMAY subsidy if:

Documents Required to Apply

Step-by-Step: How to Apply for Home Loan Subsidy in Gujarat

Step 1: Check Your Eligibility

Visit the PMAY official website and use the eligibility calculator. Choose your income category.

Step 2: Apply for a Home Loan

Approach any of the PMAY-partnered banks or NBFCs in Gujarat. Some common ones:

Ask them to process your home loan under PMAY-CLSS.

Step 3: Submit Required Documents

Provide your Aadhaar, income proof, and property documents along with your loan application. Make sure your Aadhaar is linked correctly to avoid rejection.

Step 4: Wait for Loan Sanction

Once your loan is sanctioned, the bank forwards your application for subsidy to the Central Nodal Agency (CNA) like NHB or HUDCO.

Step 5: Subsidy is Credited

If approved, the subsidy amount is directly credited to your loan account. This reduces your principal amount, and you pay lower EMIs!

Where to Get Help in Gujarat?

You can also visit your nearest ULB (Urban Local Body) office or Jan Seva Kendra in cities like:

They can help you with:

Tip: Apply Online (Directly via PMAY)

If you’ve already taken a loan and your bank didn’t apply the subsidy, you can register your details at: https://pmaymis.gov.in/

Conclusion:

Applying for a home loan subsidy in Gujarat is not complicated — but timing and documentation are critical. Take advantage of this scheme if you meet the criteria, and make your dream home more affordable.

Buying agricultural land in Gujarat can be a smart investment but it's not as simple as just choosing a plot and making the payment. The state has specific rules and legal frameworks that buyers must follow, especially if they are not farmers or residents of Gujarat. Whether you’re a resident, NRI, or investor, understanding these laws is essential to ensure your purchase is legal and future-proof.

In this blog, we break down Gujarat's agricultural land laws in a simple, buyer-friendly format.

Who Can Buy Agricultural Land in Gujarat?

Not everyone is eligible to buy agricultural land in Gujarat. As per the Bombay Tenancy and Agricultural Lands Act, 1948, which is still applicable in Gujarat:

Exception:

The District Collector has the power to grant special permission to non-farmers to purchase agricultural land for specific purposes (e.g., agro-tourism, greenhouse farming, etc.), but this involves a lengthy and uncertain approval process.

Required Documents for Purchase

To buy agricultural land legally, you'll need the following documents:

Key Legal Restrictions

Process of Buying Agricultural Land

Can You Convert Agricultural Land to NA Land?

Yes, but only with approval. You must apply to the District Collector for NA permission. Once approved, the land can legally be used for non-agricultural purposes like construction, industry, or commercial projects.

Legal Risks if Rules Are Ignored

Tips for Safe Land Purchase in Gujarat

Conclusion:

Gujarat offers fertile and high-potential agricultural land, but buying it legally requires careful navigation of state laws. If you’re a genuine farmer or planning to invest in agriculture, staying informed and compliant is the best way forward. Always prioritize due diligence over shortcuts to avoid legal trouble.

Gujarat, known for its vibrant culture and rapid industrial growth, is now making waves in another sector — coastal real estate. With over 1,600 km of coastline, Gujarat boasts one of the longest shorelines in India, touching iconic places like Diu, Dwarka, Mandvi, Porbandar, and Hazira. Today, these regions are not just tourist attractions but emerging real estate hotspots of Gujarat.

Whether you’re an investor, a retiree dreaming of a seaside home, or someone eyeing long-term value, the rise of coastal real estate in Gujarat offers promising opportunities.

Why Coastal Gujarat Is Gaining Real Estate Attention

1. Strategic Infrastructure Development

2. Rising Demand for Holiday Homes & Eco-Resorts

3. Affordable Property Rates

Top Coastal Hotspots in Gujarat for Real Estate Investment

Diu (Though UT, Real Estate Around It Booms)

Mandvi (Kutch Region)

Dwarka (Devbhoomi Dwarka)

Hazira & Dahej (Industrial + Coastal Blend)

Government Support & Real Estate Policies

Challenges to Watch

Conclusion: A Rising Tide of Opportunity

The coastal real estate boom in Gujarat is no longer a hidden secret. With solid government backing, increasing tourism, and affordable pricing, now is the right time to explore the property potential along Gujarat's beautiful shoreline. Whether for investment, leisure, or retirement the coast of Gujarat is calling.

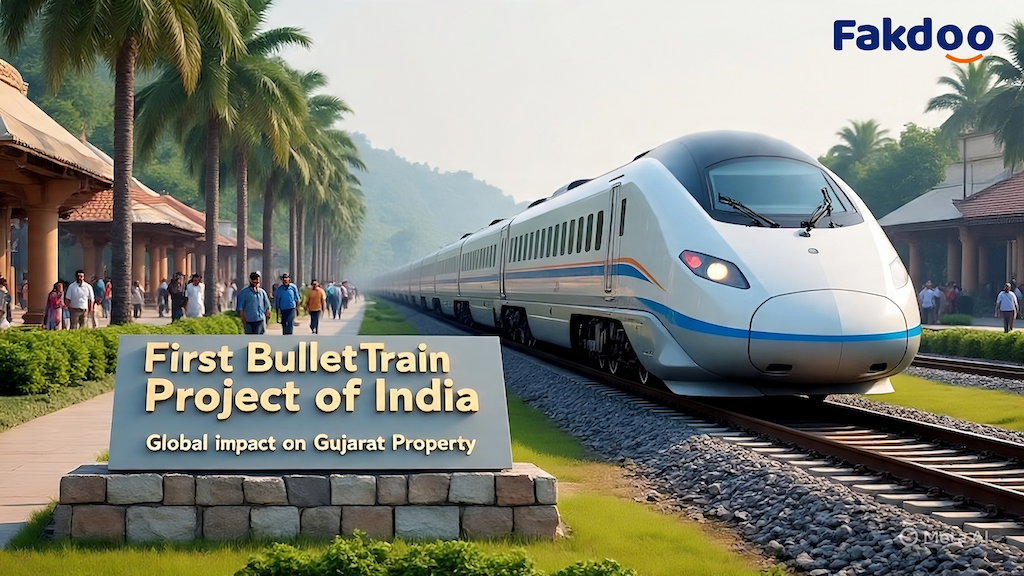

India’s first bullet train project the Mumbai-Ahmedabad High-Speed Rail Corridor is more than just a leap in transportation. It’s a signal of rapid development, and Gujarat stands to gain not just in connectivity, but also in real estate growth, global attention, and long-term investments.

In this blog, we explore how this historic infrastructure project is transforming Gujarat’s property market, attracting international interest, and unlocking new opportunities for developers, investors, and homebuyers.

Project Overview: Mumbai-Ahmedabad Bullet Train

The bullet train will cut travel time between Mumbai and Ahmedabad from 8 hours to just 2–3 hours—a game changer for business and tourism alike.

Real Estate Impact on Gujarat

1. Rising Demand in Bullet Train Cities

Cities like Surat, Vadodara, and Ahmedabad are already seeing increased interest from both residential and commercial investors. Areas near bullet train stations are becoming hot property zones.

2. Appreciation of Land Prices

Land values around proposed station zones (like Sabarmati and Anand) have seen a noticeable spike, with some regions reporting 15–25% appreciation in the past two years.

3. Boost to Commercial Real Estate

With improved inter-city connectivity, businesses are setting up corporate offices and logistics hubs in Gujarat. This creates a ripple effect on office space demand and retail development.

4. Increased NRI and Global Investment

The bullet train has caught the attention of global investors and NRIs, especially those from the USA, UK, and Gulf countries, who are now seeing Gujarat as a high-return, low-risk investment hub.

Global Interest in Gujarat’s Infrastructure Boom

Opportunities for Real Estate Developers

Gujarat Property Market: What to Expect

Conclusion:

The Mumbai-Ahmedabad bullet train is not just a transport project—it's a catalyst for Gujarat’s real estate boom. From land appreciation to international investor confidence, the project is redefining how the world sees Gujarat.

Whether you're a real estate investor, developer, or homebuyer, this is the time to keep your eyes on Gujarat. As the tracks are laid, so are the foundations for a future of growth, connectivity, and opportunity

Gujarat, known for its industrial strength and forward-thinking infrastructure, is experiencing a real estate renaissance — largely fueled by the expansion of GIFT City (Gujarat International Finance Tec-City). As India’s first operational smart city and international financial services centre (IFSC), GIFT City is not just transforming Gandhinagar’s skyline but also reshaping the future of Gujarat’s real estate landscape.

In this blog, we’ll explore how GIFT City’s expansion is impacting real estate in Gujarat — from housing and commercial investments to infrastructural development and employment growth.

What is GIFT City?

GIFT City is a visionary project by the Government of Gujarat, aimed at creating a global financial and technology hub. With state-of-the-art infrastructure, tax incentives, world-class amenities, and a robust regulatory framework, it competes with major financial centres like Dubai, Singapore, and London.

Key features include:

Real Estate Boom Around GIFT City

1. Surge in Residential Demand

With thousands of professionals expected to work in GIFT City, the demand for quality housing nearby has skyrocketed. Areas like Gandhinagar, Raysan, Randesan, and parts of North Ahmedabad are seeing:

2. Commercial and Office Space Growth

Many MNCs and financial institutions are setting up offices in GIFT City. This is driving the demand for:

3. Retail and Hospitality Expansion

To support the growing population and workforce:

Itment Opportunities

The GIFT City expansion presents lucrative investment opportunities across all real estate sectors:

Infrastructure Development as a Catalyst

The Gujarat government is actively investing in infrastructure to complement GIFT City:

These improvements are pushing real estate growth further, particularly in the Ahmedabad-Gandhinagar corridor.

GIFT City’s Global Appeal and Policy Push

Government policies such as:

are attracting global investors and developers, making Gujarat a hotspot for international real estate investment.

Final Thoughts

The expansion of GIFT City has turned Gujarat into one of India’s most promising real estate destinations. From being an industrial state to now a global financial hub, Gujarat is offering sustainable, futuristic, and high-return real estate opportunities.

Whether you're a first-time homebuyer, a seasoned investor, or a real estate developer, now is the time to explore Gujarat — not just for what it is, but for what it is rapidly becoming.

Tip for Investors:

Focus on areas within 10-15 km radius of GIFT City for optimal growth in the next 5-10 years. Residential plots, commercial spaces, and rental-focused flats are in high demand and can yield excellent returns.

Dholera is more than just a name weit’s India’s vision of a technologically advanced, sustainable, and future-ready urban space. As the first planned smart city of India, Dholera is leading the country toward a new era of infrastructure development and economic growth. Located in Gujarat, this ambitious project under the Delhi-Mumbai Industrial Corridor (DMIC) is gaining significant attention from investors, industries, and real estate developers.

Where is Dholera Located?

Dholera is strategically located about 100 km southwest of Ahmedabad in Gujarat. It lies within the Dholera Special Investment Region (SIR), covering over 920 sq. km—making it one of the largest greenfield smart city projects in India.

What Makes Dholera India’s First Planned Smart City?

Dholera was not an upgrade of an existing city but a city designed and developed from scratch, integrating smart technologies and sustainable planning from the ground up. Here's what makes it stand out:

1. Integrated Infrastructure

2. World-Class Transport Connectivity

3. Environment-Friendly Urban Planning

4. Smart Governance

Investment Opportunities in Dholera

Dholera offers vast potential for investors and businesses. Key sectors include:

With 100% FDI approval, single-window clearance, and proactive state policies, Dholera is a hotbed for domestic and global investors.

Residential and Commercial Projects

Leading developers are already launching plots, villas, apartments, and commercial spaces in Dholera. Property prices are still affordable compared to metro cities, making this the right time to invest.

Current Development Status (2025 Update)

Dholera’s Future Vision

By 2040, Dholera is expected to host:

Over 2 million residents

Over 800,000 jobs

Smart mobility (EVs, autonomous transport)

Global-standard urban services

Why You Should Keep an Eye on Dholera

Long-term capital appreciation

Smart living and work environment

Sustainable and tech-driven infrastructure

First-mover advantage for early investors

Conclusion:

Dholera isn’t just a smart city—it’s a symbol of India’s urban transformation. Whether you're a homebuyer, investor, entrepreneur, or policymaker, Dholera offers limitless potential for the future. Don’t miss your chance to be a part of India’s most ambitious city project.

India's rapid infrastructure development is not only enhancing connectivity but also reshaping the real estate landscape. With a series of high-speed expressways connecting major cities and industrial corridors, property values are witnessing unprecedented growth along these routes. This blog explores the top 10 expressways in India that are revolutionizing real estate growth and driving investor interest across the nation.

Why Expressways Matter in Real Estate Development?

The connection between expressways and real estate is stronger than ever. Improved road networks reduce travel time, encourage urban expansion, and unlock new areas for residential, commercial, and industrial development. These expressways act as economic lifelines, making real estate investment along their corridors a lucrative opportunity.

Top 10 Expressways in India Boosting Real Estate Growth

1. Delhi–Mumbai Expressway

2. Yamuna Expressway (Noida to Agra)

3. Mumbai–Pune Expressway

4. Eastern Peripheral Expressway (EPE)

5. Western Peripheral Expressway (KMP Expressway)

6. Agra–Lucknow Expressway

7. Purvanchal Expressway

8. Ahmedabad–Vadodara Expressway

9.Bangalore–Mysore Expressway (NH-275):

10.Hyderabad Outer Ring Road (ORR):

How Expressways Influence Property Values:

1. Reduced Travel Time = Higher Demand

2.Boost to Commercial & Industrial Projects

3.Affordable Options on the Outskirts

Real Estate Investment Tips Along Expressways:

Conclusion:

India’s top expressways are doing more than just connecting cities they’re redefining real estate dynamics As infrastructure continues to expand, the real estate sector stands to benefit from increased accessibility, affordability, and economic activity.

If you're a real estate investor developer, or homebuyer, keep a close watch on these expressway corridors. The road to your next great investment might just be paved with expressway lanes.

One of the most significant factors in real property is Floor Space Index (FSI), also referred to as Floor Area Ratio (FAR). FSI is defined as the total area of land that will be utilized during development. FSI is a ratio of floor area covered out of available land.

The FSI is determined by the local regulatory authorities or bodies, and it is generally determined by the Code of Building. The National Building Code of India generally provides guidelines for building construction.

FSI may be utilized to understand the desirability of the location and the population density.

In addition, comprehending the FSI is crucial, even from an ecological point of view. Since usually there are fewer spaces open if the FSI is high, the homebuyers need to consider this.

Understanding FSI and FAR:

FAR and FSI are the same but stated differently. A FAR is a decimal, while an FSI is a percentage. The FSI may vary from city to city and even within one city from one area to another. Based on the number of stories in the building, FSI may vary even in one location. FSI is regulated by city zone, building type, and other characteristics.

Prior to starting any project, contractors are required to send plans for the proposed building for approval to the respective zone. Such details involve whether the construction will be residential or commercial, how tall and what structure it would be, how big the plot of land on which it would be constructed, etc.

The place is the foremost feature that impacts the FSI directly. The FSI is usually higher in places with metros due to the limited space. But with the vast tract of land available for construction, FSI can be low in rural areas.

Some local government authorities compute higher FSIs based on area of land. Because the road is wide, any plot near one will have an increased FSI. The FSI can be computed through a simple formula using the built-up area and the area of the plot.

Floor Space Index (FSI) Formula

Floor area of all the floors and land plot area are needed to calculate the Floor Area Ratio (FAR) or Floor Space Index (FSI). It can then be estimated by the following:

FAR = Total Floor Area of All Floors of the Building/Plot Area

FSI = Total Floor Area of All Floors of the Building/Plot Area × 100

If FAR is 1, the entire plot area can be utilized as per this parameter. If FAR is less than 1, the land is underdeveloped at several places. Once again, the build-up has more than one story if FAR is more than 1.

Floor Space Index (FSI) Calculation:

Suppose you want to build a 2000-square-foot building on a piece of property which is 1000 square feet. Applying the above formula, then:

=> FAR = 2000 / 1000

=> FAR = 2

In FSI, the value is 200% if the FAR value is 2. This means that they can construct 2000 square feet on a land of 1000 square feet.

In addition, the municipal council considers the road width and other factors when determining the Floor Space Index (FSI) of a certain locality.

Importance of Floor Space Index (FSI)

FSI value determines the value of land in a particular region. Thus, this value determines whether and how much land can be utilized for a building. The FSI value differs from one location to another and is based on the number of stories each building has. Thus it is only fixed over some locations.

he FSI ensures disciplined development in every sector, such as railroad stations, commercial and residential buildings, etc., to meet the schedules, thus rendering city development and planning more standardized. This may assist in marking open areas clearly from construction areas.

No unauthorized development is allowed either.

Affordability also comes into the picture due to the fact that more FSI enables builders to construct more and sell more. This will prove handy in places where houses for all are in dire need. Less FSI implies lesser use of that piece of land for development. If the FSI builds the building, then the builder is not exposed to questions about NOCs.

Pros of Having FSI in Cities:

F.S.I. can be taken as a constraint, though it has benefits in urban areas or some areas where development is progressing very rapidly.

It maintains the ratio of developed to free space constant.

Consequently, it maintains the skyline of the city intact.

A mean value of F.S.I ensures successful development of the project.

Hence, it is important to have balance between development and planned, consistent growth.

Disadvantages of FSI:

F.S.I is considered to be a poor indicator of physical fitness there. This means that the employment of and the concept of housing the ever-growing population face lower values of F.S.I.

Therefore, one has to make an average F.S.I work as a strength and produce a 'product' that deals with all the problems at hand.

ConclusionL:

The highest floor area that can be constructed over a certain plot is calculated using the floor space index, commonly referred to as the floor area ratio. It's calculated from several variables, such as amenities, building type, and city zone classification.

The builder needs to stay within the previously determined government-approved floor space index during construction. The floor space index/area ratio greatly influences the total cost of the building. FSI is impacted by many variables, such as style of the building, size of the lot, place or location, and so on.

When it comes to ownership of property, particularly that of real estate and legal papers, two terms tend to come up: Encumbrance and Non-Encumbrance. As a buyer, seller, or investor, knowing these terms is important in order to prevent legal issues and have a smooth transaction.

In this blog, let us discuss what encumbrance and non-encumbrance are, how important they are, and the most significant differences between the two.

What is an Encumbrance?

An encumbrance is a legal claim, responsibility, or limitation on a property that can be restrictive to its usage or transfer. It implies that the property is not completely free of legal or financial burdens.

Typical Forms of Encumbrances:

Bank or financial institution liens or charges:

Encumbrance Certificate (EC)

- An Encumbrance Certificate is a formal document that the Sub-Registrar's office issues showing all registered financial or legal dealings (sale, mortgage, lease) involving a property within a specified time range.

What is a Non-Encumbrance?

- A non-encumbrance indicates that the property does not have any legal encumbrances, loans, disputes, or restrictions upon it is absolutely free and clear. In other words, it is a "clean title."

- Non-Encumbrance Certificate is not a standalone document but usually a reference to an Encumbrance Certificate indicating "No Encumbrance" for a specific time period. It means the property has not been engaged in any transaction such as a mortgage or lawsuit during that time period.

Why is it Important to Check for Encumbrances?

How to Get an Encumbrance Certificate?

Conclusion:

Whether you are purchasing a house or investing in property, knowing the encumbrance status of a property is imperative. An encumbered property may carry legal baggage, but a non-encumbered property makes you tension-free and ensures hassle-free transfer of ownership.

Always get a recent Encumbrance Certificate prior to any agreement it's a small step that can help avoid big risks in the future.

Pro Tip:

If you find a "Nil Encumbrance" noted in the certificate, it does not necessarily indicate that all is well. Always check with a lawyer or property expert, particularly for big investments.

Whether you're a homeowner, landlord, or business, your property is one of your greatest assets. What if something happens to it, though, and it gets damaged by fire, floods, theft, or acts of nature? That's where property insurance steps in.

Throughout this blog, we'll guide you through what property insurance is, why it's important, the various types out there, and how to select the most appropriate coverage for your needs.

What is Property Insurance?

Property insurance** is a form of insurance that covers your physical property such as your home, office, or rented building against loss or damage due to factors like fire, theft, vandalism, and natural disasters. It helps ensure you don't incur massive financial losses in case your property is destroyed or damaged.

This type of insurance usually protects:

Why is Property Insurance Important?

1. Financial Protection: It covers losses arising from unforeseen damage or theft.

2. Loan Requirement: Insurance is usually required by most banks to grant a home loan.

3. Peace of Mind: Having the knowledge your investment is insured provides emotional security.

4. Disaster Preparedness: Enables quick recovery from floods, earthquakes, or fires.

5. Legal Liability: Pays for legal fees if a person gets harmed on your property.

Types of Property Insurance in India:

1. Home Insurance

2. Commercial Property Insurance

3. Landlord Insurance

- Insures rental properties and covers the structure of the building, possible legal damages, and loss of rent.

4. Renter's/Tenant's Insurance

- Insures personal items in a rented home but not the building itself.

5. Natural Disaster Insurance

What Does Property Insurance Usually Cover?

NOTE: Coverage may differ based on the insurer and policy type. Always check the fine print.

What's Not Covered? (Common Exclusions)

* Intentional damage

* Wear and tear

* War or nuclear risks

* Poor maintenance

* Damage caused by pests (e.g., termites, rodents)

* Undeclared or underinsured assets

How to Choose the Right Property Insurance Policy:

1. Determine the Value of Your Property & Contents

Don't under-insure cover cost of rebuilding and replacing valuable property.

2. Compare Policies Online

Compare insurance policies using comparison websites to get the best combination of coverage and premium.

3. Check Add-ons & Riders

Personalize your policy with add-ons such as earthquake or flood cover.

4. Read the Terms & Conditions

Know what's included, what's excluded, and what documents you'll need if there's a claim.

5. Select a Reliable Insurer

Opt for those companies that have a reputation for settling claims fast and have high customer service.

How to Make a Property Insurance Claim

1.Report the insurer at once after the damage or loss.

2.Get images of the damage with photos and video.

3. Make a police report (where there has been theft or vandalism).

4. Send all the documents such as proof of ownership, FIR, estimate of repairs, etc.

5. Follow up periodically until the claim settles.

How Much Does Property Insurance Cost?

The premium varies based on:

* Location and size of property

* Sum insured (property and content value)

* Type of coverage chosen

* Risk profile (high-risk flood area, crime rate, etc.)

In general, home insurance premiums are relatively low usually ranging from as low as ₹500–₹2,000 a year for minimum coverage.

Conclusion

Property insurance is not just a safety net—it’s a smart investment in your future. Whether you’re protecting your family home or your business premises, having the right policy in place ensures that one accident or disaster doesn’t wipe out years of hard-earned savings.

Gujarat has traditionally been India's industrial heartland. With its location at the center of India, investor-friendly policies, and superior infrastructure, the state remains a magnet for large-scale investments in industry and infrastructure. Among the most exciting initiatives in this context is the Becharaji Industrial Park, which lies within the Mandal Becharaji Special Investment Region (MBSIR). This is increasingly becoming a center for smart, sustainable industrialization in Gujarat.

What is Becharaji Industrial Park?

Becharaji Industrial Park is one of the ambitious MBSIR, a Special Investment Region spanning almost 102 square kilometers. It lies in North Gujarat close to Mehsana and is strategically located to cater to strategic industrial corridors, particularly the Delhi-Mumbai Industrial Corridor (DMIC).

The park aims to facilitate intelligent industrial growth by emphasizing the manufacture of automobiles, engineering, electronics, and logistics. The park has some of the big automobile players, including Suzuki Motor Gujarat, which has set up one of its largest production units here.

Major Features of Becharaji Industrial Park

Becharaji is most famous for its automobile cluster, with Suzuki and its Tier-1 and Tier-2 vendors having operations spread across the area. Other industries too, however, are finding a niche space here:

Gujarat provides a strong policy framework with the Gujarat Industrial Policy 2020, offering:

Employment & Economic Impact:

Becharaji Industrial Park is likely to create more than 2 lakh direct and indirect employment opportunities in the coming decade. It is not only an industrial hub but also a catalyst of regional development, elevating neighboring towns and villages with improved infrastructure, education, and employment prospects.

Future Outlook

With continued growth of exclusive freight corridors, intelligent utilities, and public-private partnership models, Becharaji Industrial Park is ready to emerge as a manufacturing hub in the world. Investors who would like to benefit from India's industrial upsurge should find MBSIR a desirable location.

Conclusion:

Becharaji Industrial Park is an example of Gujarat's dedication to smart, inclusive, and sustainable industrialization. You are either an investor, entrepreneur, or policymaker, this park is the future of industrial excellence in India.

The commercial real estate sector is experiencing a strong revival, and 2025 is shaping up to be a landmark year. With shifting business landscapes, expanding industries, and increased investor confidence, the demand for commercial property leases is witnessing a noticeable rise across major cities in India and globally.

Whether you're a business owner, investor, or real estate developer, understanding this surge is crucial to making informed decisions.

Why Is Commercial Leasing on the Rise in 2025?

1. Post-Pandemic Business Expansion

Companies that paused growth plans during the pandemic are now aggressively expanding. From tech startups to logistics giants, businesses are leasing office spaces, warehouses, and retail outlets to meet growing operational needs.

2. Boom in E-commerce and Warehousing

The rapid growth of online shopping has led to higher demand for logistics hubs, warehouses, and distribution centers. Leasing large industrial spaces has become essential for businesses aiming to scale efficiently.

3. Hybrid Work Culture Stabilizing Office Demand

While remote work persists, many organizations are adopting hybrid models. This has fueled demand for flexible office spaces in business districts and co-working hubs in tier-1 and tier-2 cities.

4. Favorable Government Policies

Initiatives like Make in India, Smart Cities Mission, and ease of doing business reforms have encouraged domestic and foreign businesses to set up operations, increasing the leasing activity in commercial zones.

5. Rising Investor Confidence

Real estate investors are seeing commercial property as a stable and high-yield asset. Leasing demand ensures consistent rental income and long-term value appreciation, making it a popular choice in 2025 portfolios.

Key Commercial Segments Driving the Demand

Locations in India Witnessing High Leasing Demand in 2025

Tips for Investors & Businesses

Conclusion:

The commercial leasing market in 2025 is on a steady upward trajectory, driven by economic recovery, evolving work models, and increased investor interest. For anyone looking to lease, invest, or develop commercial property, now is the time to act.

Buying your dream home in Gujarat just got easier with the Pradhan Mantri Awas Yojana (PMAY) — a government scheme offering home loan subsidies for eligible applicants. Whether you're a first-time homebuyer or looking to make housing more affordable, this blog will guide you step-by-step on how to apply for a home loan subsidy in Gujarat.

What is a Home Loan Subsidy?

A home loan subsidy is a financial assistance provided by the government under schemes like PMAY. Through this, eligible individuals get interest rate reductions on home loans making monthly EMIs much more affordable.

The Credit Linked Subsidy Scheme (CLSS) under PMAY is specifically designed for this purpose.

Who is Eligible for Home Loan Subsidy in Gujarat?

You can apply for the PMAY subsidy if:

Documents Required to Apply

Step-by-Step: How to Apply for Home Loan Subsidy in Gujarat

Step 1: Check Your Eligibility

Visit the PMAY official website and use the eligibility calculator. Choose your income category.

Step 2: Apply for a Home Loan

Approach any of the PMAY-partnered banks or NBFCs in Gujarat. Some common ones:

Ask them to process your home loan under PMAY-CLSS.

Step 3: Submit Required Documents

Provide your Aadhaar, income proof, and property documents along with your loan application. Make sure your Aadhaar is linked correctly to avoid rejection.

Step 4: Wait for Loan Sanction

Once your loan is sanctioned, the bank forwards your application for subsidy to the Central Nodal Agency (CNA) like NHB or HUDCO.

Step 5: Subsidy is Credited

If approved, the subsidy amount is directly credited to your loan account. This reduces your principal amount, and you pay lower EMIs!

Where to Get Help in Gujarat?

You can also visit your nearest ULB (Urban Local Body) office or Jan Seva Kendra in cities like:

They can help you with:

Tip: Apply Online (Directly via PMAY)

If you’ve already taken a loan and your bank didn’t apply the subsidy, you can register your details at: https://pmaymis.gov.in/

Conclusion:

Applying for a home loan subsidy in Gujarat is not complicated — but timing and documentation are critical. Take advantage of this scheme if you meet the criteria, and make your dream home more affordable.

Buying agricultural land in Gujarat can be a smart investment but it's not as simple as just choosing a plot and making the payment. The state has specific rules and legal frameworks that buyers must follow, especially if they are not farmers or residents of Gujarat. Whether you’re a resident, NRI, or investor, understanding these laws is essential to ensure your purchase is legal and future-proof.

In this blog, we break down Gujarat's agricultural land laws in a simple, buyer-friendly format.

Who Can Buy Agricultural Land in Gujarat?

Not everyone is eligible to buy agricultural land in Gujarat. As per the Bombay Tenancy and Agricultural Lands Act, 1948, which is still applicable in Gujarat:

Exception:

The District Collector has the power to grant special permission to non-farmers to purchase agricultural land for specific purposes (e.g., agro-tourism, greenhouse farming, etc.), but this involves a lengthy and uncertain approval process.

Required Documents for Purchase

To buy agricultural land legally, you'll need the following documents:

Key Legal Restrictions

Process of Buying Agricultural Land

Can You Convert Agricultural Land to NA Land?

Yes, but only with approval. You must apply to the District Collector for NA permission. Once approved, the land can legally be used for non-agricultural purposes like construction, industry, or commercial projects.

Legal Risks if Rules Are Ignored

Tips for Safe Land Purchase in Gujarat

Conclusion:

Gujarat offers fertile and high-potential agricultural land, but buying it legally requires careful navigation of state laws. If you’re a genuine farmer or planning to invest in agriculture, staying informed and compliant is the best way forward. Always prioritize due diligence over shortcuts to avoid legal trouble.

Gujarat, known for its vibrant culture and rapid industrial growth, is now making waves in another sector — coastal real estate. With over 1,600 km of coastline, Gujarat boasts one of the longest shorelines in India, touching iconic places like Diu, Dwarka, Mandvi, Porbandar, and Hazira. Today, these regions are not just tourist attractions but emerging real estate hotspots of Gujarat.

Whether you’re an investor, a retiree dreaming of a seaside home, or someone eyeing long-term value, the rise of coastal real estate in Gujarat offers promising opportunities.

Why Coastal Gujarat Is Gaining Real Estate Attention

1. Strategic Infrastructure Development

2. Rising Demand for Holiday Homes & Eco-Resorts

3. Affordable Property Rates

Top Coastal Hotspots in Gujarat for Real Estate Investment

Diu (Though UT, Real Estate Around It Booms)

Mandvi (Kutch Region)

Dwarka (Devbhoomi Dwarka)

Hazira & Dahej (Industrial + Coastal Blend)

Government Support & Real Estate Policies

Challenges to Watch

Conclusion: A Rising Tide of Opportunity

The coastal real estate boom in Gujarat is no longer a hidden secret. With solid government backing, increasing tourism, and affordable pricing, now is the right time to explore the property potential along Gujarat's beautiful shoreline. Whether for investment, leisure, or retirement the coast of Gujarat is calling.

India’s first bullet train project the Mumbai-Ahmedabad High-Speed Rail Corridor is more than just a leap in transportation. It’s a signal of rapid development, and Gujarat stands to gain not just in connectivity, but also in real estate growth, global attention, and long-term investments.

In this blog, we explore how this historic infrastructure project is transforming Gujarat’s property market, attracting international interest, and unlocking new opportunities for developers, investors, and homebuyers.

Project Overview: Mumbai-Ahmedabad Bullet Train

The bullet train will cut travel time between Mumbai and Ahmedabad from 8 hours to just 2–3 hours—a game changer for business and tourism alike.

Real Estate Impact on Gujarat

1. Rising Demand in Bullet Train Cities

Cities like Surat, Vadodara, and Ahmedabad are already seeing increased interest from both residential and commercial investors. Areas near bullet train stations are becoming hot property zones.

2. Appreciation of Land Prices

Land values around proposed station zones (like Sabarmati and Anand) have seen a noticeable spike, with some regions reporting 15–25% appreciation in the past two years.

3. Boost to Commercial Real Estate

With improved inter-city connectivity, businesses are setting up corporate offices and logistics hubs in Gujarat. This creates a ripple effect on office space demand and retail development.

4. Increased NRI and Global Investment

The bullet train has caught the attention of global investors and NRIs, especially those from the USA, UK, and Gulf countries, who are now seeing Gujarat as a high-return, low-risk investment hub.

Global Interest in Gujarat’s Infrastructure Boom

Opportunities for Real Estate Developers

Gujarat Property Market: What to Expect

Conclusion:

The Mumbai-Ahmedabad bullet train is not just a transport project—it's a catalyst for Gujarat’s real estate boom. From land appreciation to international investor confidence, the project is redefining how the world sees Gujarat.

Whether you're a real estate investor, developer, or homebuyer, this is the time to keep your eyes on Gujarat. As the tracks are laid, so are the foundations for a future of growth, connectivity, and opportunity

Discounts on Package Ads

Discounts on Package Ads